Your Tempe Roofers Insurance Specialists

PrimeRisk Insurance has protected over 95 Tempe roofing contractors with coverage tailored to this university city's specific challenges. Our straightforward process gets your roofing business protected quickly:

- Tell us about your Tempe roofing business

- Get coverage recommendations specific to Tempe roofers

- Choose the protection package that works for your urban roofing company

Prescott Roofing Regulations & Requirements

Building Code Requirements

Tempe has adopted the 2018 International Building Code with local amendments specific to urban development:

- Enhanced energy efficiency requirements

- Specific flashing and drainage requirements

- Heat-resistant underlayment specifications

- Solar reflectivity standards for certain roof types

- Special requirements for multi-family structures

- Waterfront development considerations near Tempe Town Lake

- University district requirements for campus-adjacent properties

Permit Requirements

All roofing projects in Tempe exceeding $1,000 or affecting structural elements require permits from Tempe Development Services. Permit applications must include:

- Project scope and valuation

- Property information

- Contractor license information

- Proof of insurance

- Plans for structural modifications (if applicable)

- Historic district approval (if applicable)

- HOA approval documentation (if applicable)

- University district compliance (if applicable)

Historic District Requirements

Tempe's historic districts, including Maple-Ash and University Park, have specific requirements for roofing work:

- Materials must match historic character of the neighborhood

- Certain modern materials may be prohibited

- Plans must be reviewed by the Tempe Historic Preservation Commission

- Special permits required for contributing historic structures

- Restoration rather than replacement is often preferred

Licensing Requirements

Tempe roofing contractors must hold an Arizona CR-42 (Roofing) license from the Arizona Registrar of Contractors. This requires:

- Passing trade and business management exams

- Providing proof of experience (4 years minimum)

- Submitting financial statements

- Maintaining a $15,000 license bond

- Carrying minimum general liability insurance

Unique Risk Factors for Tempe Roofers

University-Adjacent Property Exposure

Tempe's position as home to Arizona State University creates unique liability exposures for roofers. Properties near campus often have higher occupancy rates, more frequent turnover, and greater foot traffic than standard residential areas. Working on these properties increases both liability and property damage risks due to the density of occupants and higher likelihood of unreported maintenance issues.

Lakefront Development Considerations

Tempe Town Lake has transformed the city with premium waterfront developments that present specialized roofing challenges. These properties often feature complex roof designs, high-value finishes, and water proximity considerations. Roofers working on lakefront properties face increased liability exposure due to both the higher property values and the potential for water-related complications.

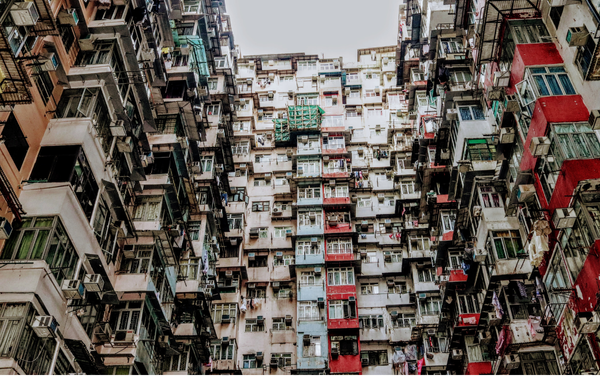

Urban Density Challenges

Tempe's urban core features significant density, with multi-family structures, mixed-use developments, and limited access conditions. Roofers working in these areas face logistical challenges including restricted equipment placement, material staging limitations, and proximity to pedestrians and vehicles. These urban conditions increase both workers' compensation exposures and third-party liability risks.

Mixed Commercial-Residential Projects

Tempe's growing number of mixed-use developments combines commercial and residential elements within single structures. These projects create complex liability exposures as they blur the lines between commercial and residential insurance requirements. Roofers must navigate different standards, expectations, and potential claims scenarios when working on these increasingly common Tempe properties.

Common Questions from Tempe Roofing Contractors

How much does roofers insurance cost in Tempe?

Roofers insurance in Tempe typically costs 10-20% more than other contractor trades due to the high-risk nature of roofing work, with rates reflecting the city's unique urban risk profile.

For a small Tempe roofing company (1-5 employees), expect to pay approximately:

- General Liability: $3,500-$6,000 annually for $1M/$2M coverage

- Workers' Compensation: $8,000-$14,800 annually (rates of $15-$25 per $100 of payroll)

- Commercial Auto: $1,800-$3,000 per vehicle annually

- Tools & Equipment: $500-$1,200 annually

- Business Owner's Policy: $1,200-$2,500 annually

Factors specifically affecting Tempe roofers insurance costs include:

- Work in university-adjacent areas vs. established neighborhoods

- Lakefront property exposure

- Urban density and access conditions

- Types of roofs you work on (commercial, residential, mixed-use)

- Percentage of new construction vs. repair work

- Claims history and years in business

- Safety protocols for urban work environments

- Whether you perform hot tar work

- Annual revenue and project values

Tempe roofers can often reduce premiums by implementing comprehensive safety programs, documenting urban work protocols, specializing in specific types of roofing, and choosing higher deductibles for property coverages.

What's the best insurance package for roofers working on Tempe's mixed-use developments?

Roofing contractors working on Tempe's growing number of mixed-use developments need specialized coverage. The best insurance package for these properties ensures comprehensive protection against a variety of risks associated with both residential and commercial elements. Here’s a breakdown of the essential coverages.

1. Enhanced General Liability Insurance

- Minimum limits of $1M per occurrence/$2M aggregate

- Specific endorsements for mixed-use structures

- Extended completed operations coverage (minimum 5 years)

- Additional insured endorsements for property owners, developers, and management companies

- Defense costs outside policy limits

- No exclusions for commercial-residential hybrid projects

- Coverage for both residential and commercial claims scenarios

2. Professional Liability/Errors & Omissions

- Minimum limits of $1M

- Coverage for design recommendations on complex systems

- Protection for consulting on material selection

- Coverage for compliance with mixed-use building codes

3. Workers' Compensation with Urban Work Endorsements

- Statutory coverage with employer's liability limits of $1M

- Coverage for restricted access conditions

- Enhanced safety training requirements for urban environments

- Protection for pedestrian exposure risks

4. Commercial Auto with Urban Considerations

- $1M combined single limit coverage

- Enhanced coverage for navigating congested urban areas

- Protection for vehicles in limited staging areas

- Coverage for equipment transport in dense environments

5. Commercial Umbrella

- Minimum $3M in additional liability protection

- Extends over all underlying policies

- Critical for high-value mixed-use properties

6. Additional Recommended Coverages

- Tools & equipment coverage with theft protection

- Builder's risk with specific provisions for mixed-use materials

- Business interruption coverage for project delays

- Pollution liability for urban environmental concerns

At PrimeRisk, we partner with insurance carriers that specialize in mixed-use development work and understand Tempe's unique urban landscape, offering tailored coverage that protects your business when working on these complex properties.

What Are the Biggest Insurance Claims for Roofers in Tempe?

Based on our experience insuring Tempe roofing contractors, the most common and costly insurance claims include:

1. Water Intrusion in Multi-Unit Structures

Water damage claims in Tempe's multi-family and mixed-use buildings can be extraordinarily complex and expensive. These claims often affect multiple units and can involve both residential and commercial spaces. Water intrusion claims typically average $25,000-$75,000 but can exceed $150,000 in significant multi-unit properties.

2. University-Adjacent Property Damage

Claims involving properties near ASU often have unique complications due to high occupancy rates and frequent tenant turnover. These claims typically average $15,000-$40,000 and may involve multiple parties including property management companies, student tenants, and university-related entities.

3. Urban Access-Related Incidents

Tempe's urban density creates unique access challenges that lead to third-party property damage and injury claims. These incidents, often involving pedestrians, vehicles, or adjacent properties, average $10,000-$30,000 per occurrence.

4. Heat-Related Worker Injuries in Urban Settings

Urban work environments can amplify heat conditions due to reflected heat from surrounding structures and limited air circulation. These workers' compensation claims typically average $8,000-$15,000 per incident, with potential for higher costs if hospitalization is required.

5. Lakefront Property Complications

Claims involving Tempe's premium lakefront properties often have higher severity due to property values and water proximity considerations. These claims average $20,000-$60,000 but can be significantly higher for luxury waterfront developments.

PrimeRisk helps Tempe roofers implement specific risk management strategies to address these common claims, potentially reducing your premiums while protecting your business in this dynamic urban environment.

How Does Tempe Roofers Insurance Differ from Other East Valley Cities?

Tempe roofers face several different insurance considerations compared to other East Valley cities:

These differences mean Tempe roofers need specialized coverage that addresses urban risks rather than standard suburban construction coverage. PrimeRisk tailors coverage specifically to Tempe roofing contractors, with options that address these unique urban factors while maintaining competitive rates.

What insurance do I need for roofing projects near Arizona State University?

For projects near Arizona State University and in Tempe's university district, roofing contractors need enhanced insurance coverage:

| Required Coverages | Details |

|---|---|

| Commercial General Liability | Minimum limits of $1,000,000 per occurrence and $2,000,000 aggregate, with specific endorsements for high-occupancy properties |

| Professional Liability/E&O | Minimum of $1,000,000 for contractors involved in system design or material selection |

| Products/Completed Operations | Extended coverage period of at least 5 years |

| Workers' Compensation | Statutory coverage with employer's liability limits of $1,000,000 |

| Commercial Auto | Minimum limit of $1,000,000 combined single limit |

| Umbrella Liability | Additional $2,000,000 recommended due to the high-density nature of these properties |

Additional Requirements

- Property management companies often require additional insured status

- Waiver of subrogation in favor of property owners

- 30-day notice of cancellation provision

- Certificates must specifically note work in the university district

- Some projects may require performance bonds

Special Considerations for University District Roofing:

- Coverage for high-occupancy property risks

- Protection for claims involving multiple tenants

- Coverage for restricted access conditions

- Enhanced security protocols for occupied buildings

- Protection for pedestrian exposure

PrimeRisk specializes in helping Tempe roofers meet university district requirements and can provide the necessary certificates and endorsements to qualify for these specialized projects.

Tempe Roofer Success Stories

"When we started taking on projects near ASU, we discovered how different the insurance requirements were. PrimeRisk helped us secure the specialized coverage needed for high-occupancy properties, including enhanced liability limits and specific endorsements required by property management companies."

- Jennifer Martinez, University District Roofing, Tempe

"After winning a contract for a mixed-use development near Tempe Town Lake, we needed comprehensive coverage that addressed both commercial and residential exposures. PrimeRisk delivered a tailored package that protected us through every phase of this complex project."

- Michael Thompson, Urban Roofing Solutions, Tempe

"The logistical challenges of working in Tempe's urban core create unique risks. When a pedestrian claimed injury from debris near our job site, PrimeRisk's liability coverage protected our business from a potentially devastating claim. Their urban work expertise made all the difference."

- David Wilson, Tempe Roofing Specialists, Tempe

Essential Coverage for Tempe Roofers

1. University District Liability

Our Tempe roofer general liability policies include specific endorsements for work on high-occupancy, campus-adjacent properties. We provide completed operations coverage extending 5+ years, critical for properties with frequent tenant turnover. Coverage includes protection for multiple-tenant claims and high-density occupancy risks common near ASU.

2. Mixed-Use Development Protection

Essential for Tempe roofers working on the city's growing number of commercial-residential hybrid projects, this specialized coverage addresses the complex liability exposures created by mixed-use structures. Coverage includes protection for both commercial and residential claims scenarios within the same project.

3. Urban Work Environment Coverage

Designed specifically for Tempe's dense urban core, this coverage provides enhanced protection for third-party liability in high-traffic areas. Coverage includes protection for pedestrian exposure, limited access conditions, and the unique risks of working in congested urban environments.

4. Lakefront Property Specialized Coverage

Our Tempe-specific lakefront property coverage addresses the unique risks of working on premium waterfront developments near Tempe Town Lake. Coverage includes protection for higher-value property exposure, water proximity considerations, and the specialized systems often found in these distinctive properties.